The traditional model of real estate investment has long been criticized for its limitations. High upfront costs, geographical barriers, and complex legalities have historically restricted participation for a significant portion of the population. However, a new wave of innovation is transforming the landscape, fueled by technological advancements and a growing appetite for alternative investment strategies. Companies like USP are at the forefront of this movement, pioneering the use of blockchain technology to dismantle these barriers and democratize real estate ownership.

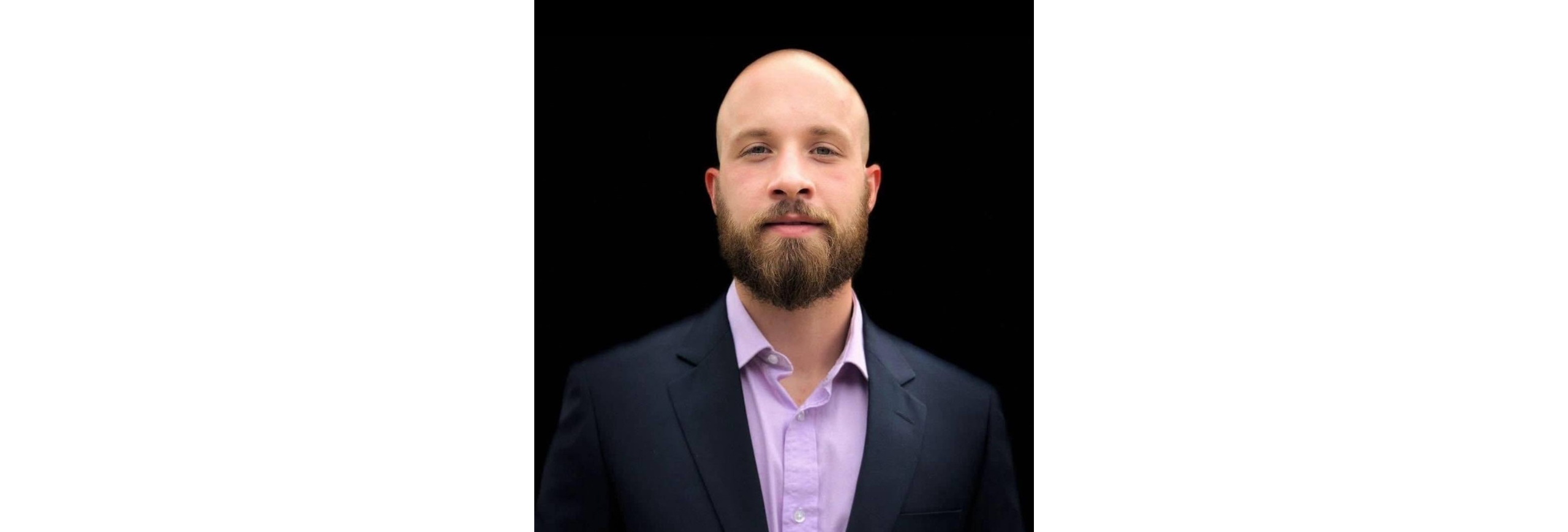

Founded by entrepreneur Johnney Zhang, USP’s core mission revolves around creating a more inclusive real estate investment ecosystem. Historically, the high capital required for entry has limited participation to individuals with significant resources. USP’s solution lies in the innovative concept of tokenization. By leveraging blockchain technology, USP transforms tangible real estate assets into digital tokens—the USP Token. These tokens represent fractional ownership in income-generating properties. Imagine co-owning a slice of a bustling downtown office building or a prime California vacation rental—all through the ownership of a USP Token. This approach unlocks a world of possibilities for a wider range of investors, allowing individuals with smaller investment amounts to participate in the previously exclusive world of real estate.

The potential benefits of tokenization extend beyond increased accessibility. For individual investors, it offers the opportunity to diversify their portfolios with smaller investment amounts compared to traditional real estate purchases. Additionally, it eliminates geographical constraints. An investor in New York City can now hold a stake in a property located in Los Angeles, all facilitated through a secure digital platform. Furthermore, the inherent transparency and immutability of blockchain technology enhance security and streamline transaction processes. The tedious paperwork and lengthy closing times associated with traditional real estate transactions could become a thing of the past.

USP has already made demonstrable progress in its tokenization efforts. With over $52 million worth of Southern California properties currently tokenized, the company is actively showcasing the real-world application of this technology. The development of the USP Tokenized Real Estate Marketplace, still in its early stages, further underscores USP’s commitment to simplifying investment processes. This platform aims to provide a user-friendly interface for purchasing USP tokens, potentially attracting a new generation of investors to the real estate market. Imagine a future where investing in real estate is as easy and accessible as buying a stock online.

However, venturing into a nascent field inevitably presents challenges. The relatively new world of blockchain technology can generate skepticism among potential investors, particularly those accustomed to traditional investment avenues. Furthermore, the allure of quick returns associated with certain speculative assets like meme coins can overshadow the long-term value proposition offered by USP Tokens. USP’s strategy to address these concerns is two-pronged.

Firstly, the company emphasizes the inherent stability and potential for sustainable growth associated with real estate investments. By drawing parallels to the early days of Bitcoin, USP aims to resonate with institutional investors seeking secure and dependable growth opportunities. Secondly, the company actively advocates for clear regulatory frameworks surrounding tokenized assets. Such regulations are seen as crucial for building trust and fostering widespread adoption within the investment community.

USP represents a significant development in the evolution of real estate investment. By leveraging blockchain technology, the company seeks to democratize access to a historically exclusive market. While challenges remain, USP’s innovative approach and commitment to transparency hold the potential to reshape the landscape of real estate ownership. Their vision of a more accessible and inclusive investment experience has the potential to unlock new opportunities for a wider range of participants, potentially redefining the way we invest in real estate for years to come.

Written in partnership with Tom White.