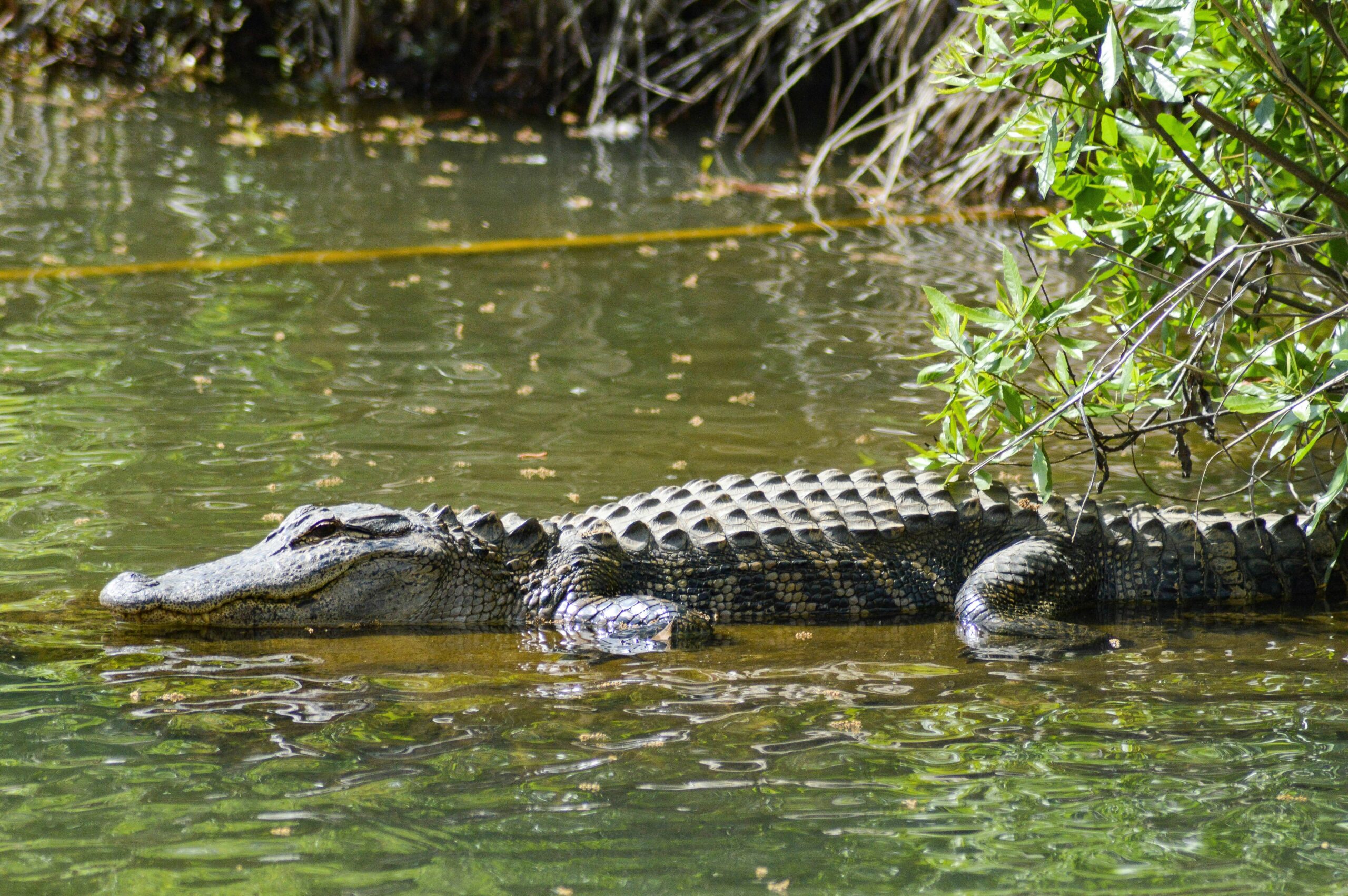

Image credit: Pexels

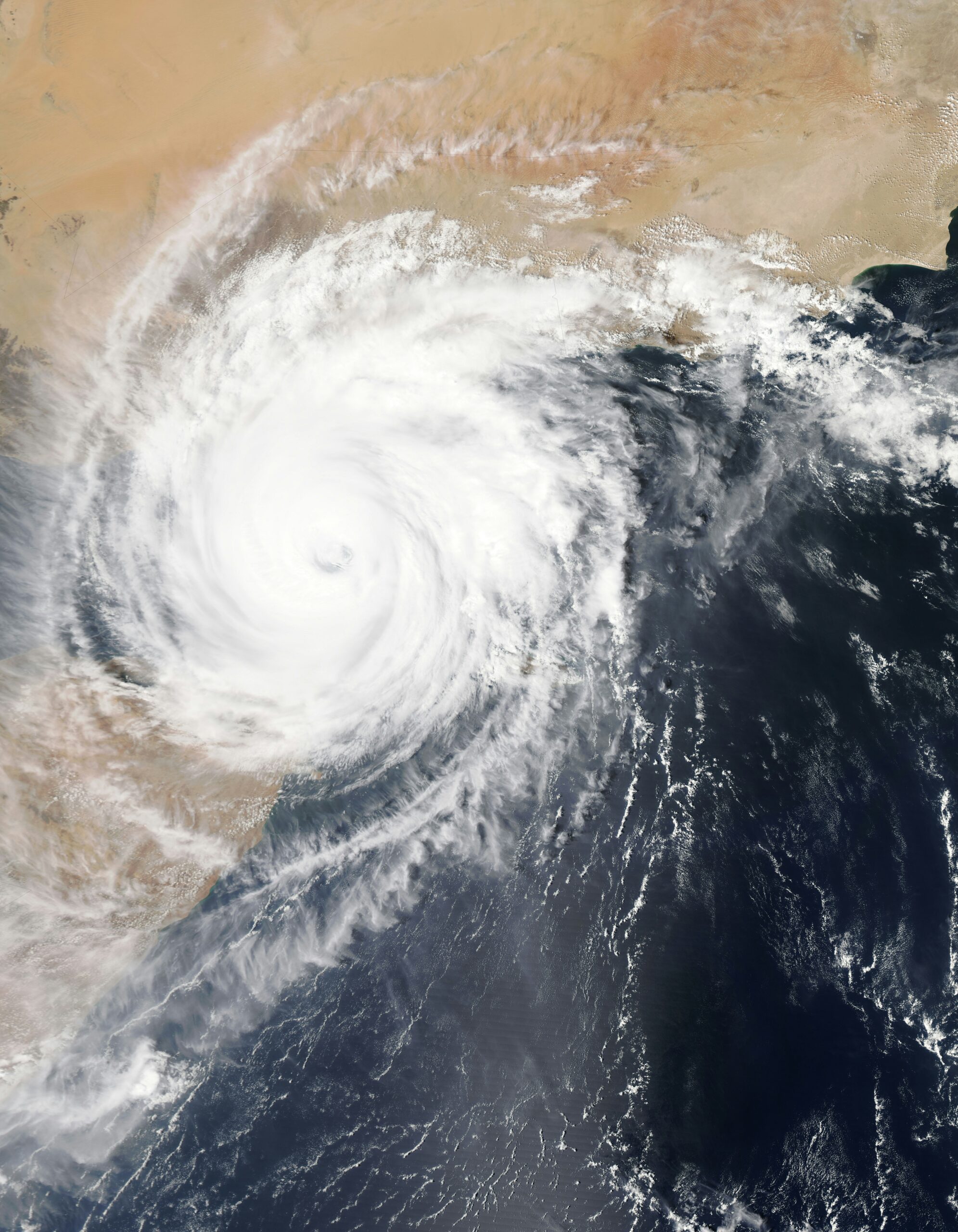

The draw of the Florida sunshine brings visitors for vacation and often converts them to residents. Although Florida provides a dream destination to call home, it also comes with the risk of natural disasters, especially hurricanes. While you may be comfortable with some risks in exchange for the Florida lifestyle, it comes with a cost.

Insuring homes in natural disaster-prone areas can be expensive and even prohibitive. Learn what to look for in a potential insurer to help safeguard your property with the right coverage.

1. Learn the Difference a Coastal Home Makes on Coverage

Where you live influences what homeowners insurance coverage you need and may even exclude you from important coverage. If you live in a high-risk area, standard coverage for wind damage may not be available. Instead, you may need hurricane-specific coverage and windstorm coverage.

Additionally, you may have separate deductibles for your overall policy and those that represent a higher likelihood of recurrence. For example, homes in the Midwest often have higher deductibles for roof replacement thanks to the probability of hail damage.

In a Florida home, windstorms may be more prevalent, even when further away from the direct path of a hurricane. Since this type of damage is more likely to occur, the deductible is often a percentage of the home’s value. While homeowners cannot change this reality of the policy, understanding potential deductible costs can help you plan.

Review your options for home insurance in Florida and assess your current policy and potential insurers’ quotes side-by-side. Look at each policy’s exclusions and deductibles to compare rates and coverage limits to make an informed decision.

2. Find Out What Additional Coverage is Available

A home insurance provider often has a standard policy document for the average homeowner. However, when you request a quote, be sure to share specifics unique to your home’s construction, features, and location.

Some coverage types are required to be offered based on your responses or the state insurance authorities’ rules. Your provider should offer a quote that includes any state or federally required coverage.

For example, if you live in a flood plain, you will need to purchase flood insurance for your property. Sometimes this can be accessed through the national flood insurance program or your homeowners’ insurance provider. Confirm where your property is on federal flood maps to determine your home’s risk level.

Even non-coastal homes can experience flooding from other bodies of water or home disasters like a failed sump pump. Take your time reviewing quotes and get a full range of options for additional coverage and their rates.

3. Assess Replacement Costs and Building Limits

Once you have quotes in hand, compare the replacement cost limitations for your policies. Some policies may have a lifetime limit on certain claims, so weigh the risk among each provider. Most policies will have coverage limits per incident, so review quoted coverage and determine if it’s adequate for your situation.

For example, different providers may have different calculations for replacement costs based on their actuarial factors. If your home is built out of unique materials that are expensive to replace, discuss this with potential providers. In this situation, you may need an appraisal to confirm the appropriate replacement cost.

Increasing coverage will likely increase rates, but when disaster strikes, you can feel confident that you can be made whole. Conduct an annual review of your policy to check rates and provider coverage changes, and to incorporate any upgrades. Some non-storm-related upgrades can further drive down rates, which can ease the pressure on nationwide rate increases.

4. Find Out What Home Improvements Could Decrease Rates

While you may think about home improvements specific to increasing your home’s value, some can also improve your insurance rates. Fortified features can protect your home in the event of a natural disaster.

Hurricane-resistant windows, storm shutters, and reinforced roofs can decrease the likelihood of major damage. These enhancements can improve your feelings of security in the home and reduce storm-related claims. While these improvements require an initial investment, the insurance savings can help you recoup the upfront cost. Ask your insurer if these enhancements would decrease rates and if they require proof of upgrade to update your policy.

Work with a reputable contractor specializing in hurricane-rated building upgrades who can offer you a range of options. Some upgrades may not improve your insurance rates but they can protect your home and sense of security. Additionally, exterior features like landscaping, hardscaping, and shade structures can help or hinder your protection. Ideally, you can incorporate storm-safe features that are attractive, functional, and protect your home from damage.

Be Proactive in Protecting What’s Yours

Familiarize yourself with common insurance coverage terms like replacement cost, deductible, and limitations to make informed decisions about insurance. Ask questions when you get quotes from potential providers so you understand how their company handles claims. Invest in additional coverage, especially flood insurance, to handle large disasters and more isolated issues like basement backups. An investment in high-quality homeowners insurance can protect your home and your finances in the event of a disaster. With a proactive approach, you can be confident that, even when disaster strikes, you’ve protected your home and your future.

Written in partnership with Tom White