Image credit: Unsplash

Florida will be holding its second back-to-school sales tax holiday from January 1 through January 14, 2024. This is the first time the state is partaking in two sales tax holidays in one year.

The state’s original back-to-school sales tax holiday was held from July 24 through August 6, as is traditional. However, new legislation was passed earlier this year approving this second sales tax holiday for the 2023-2024 school year to help parents shoulder Florida’s 7.02 percent sales tax.

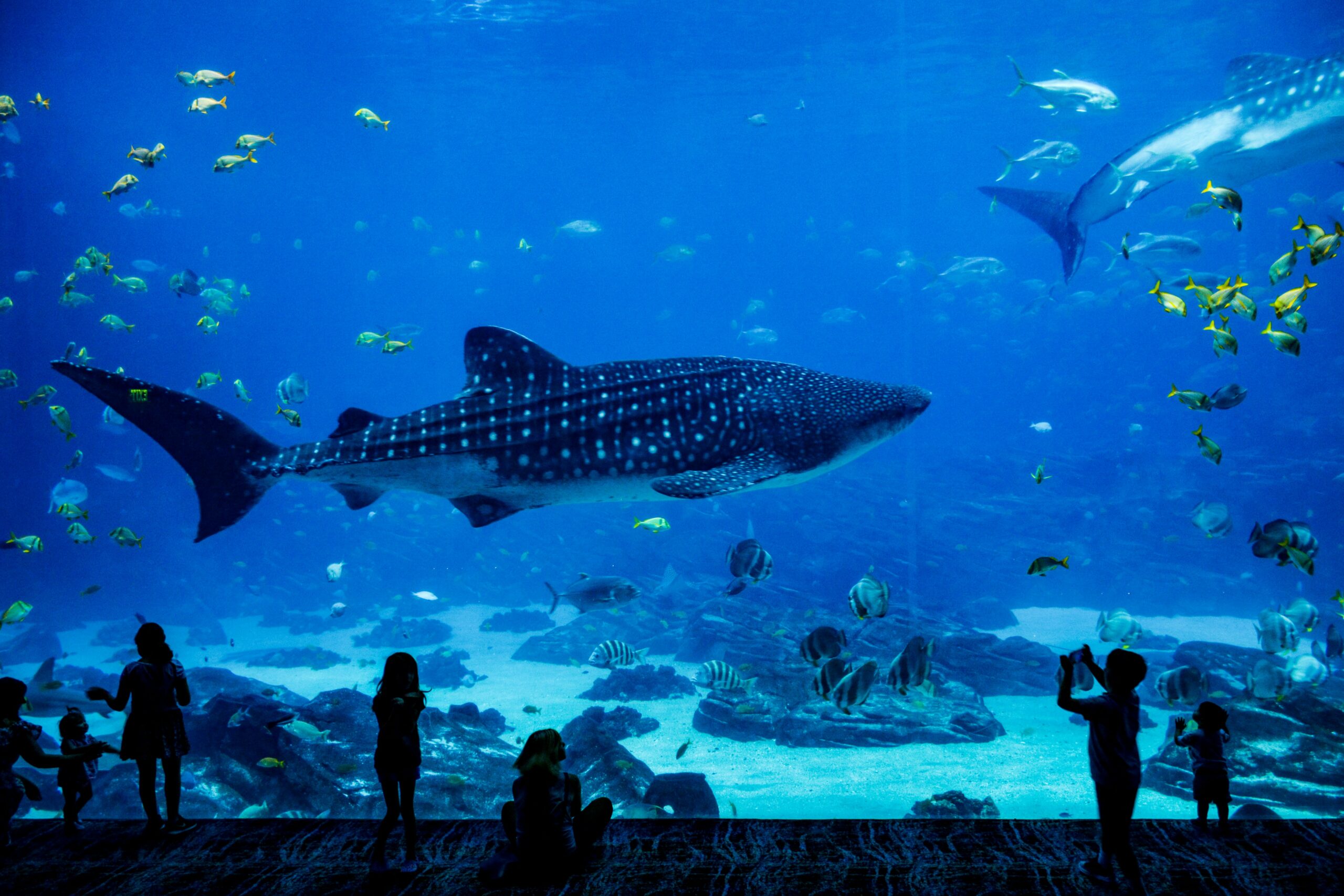

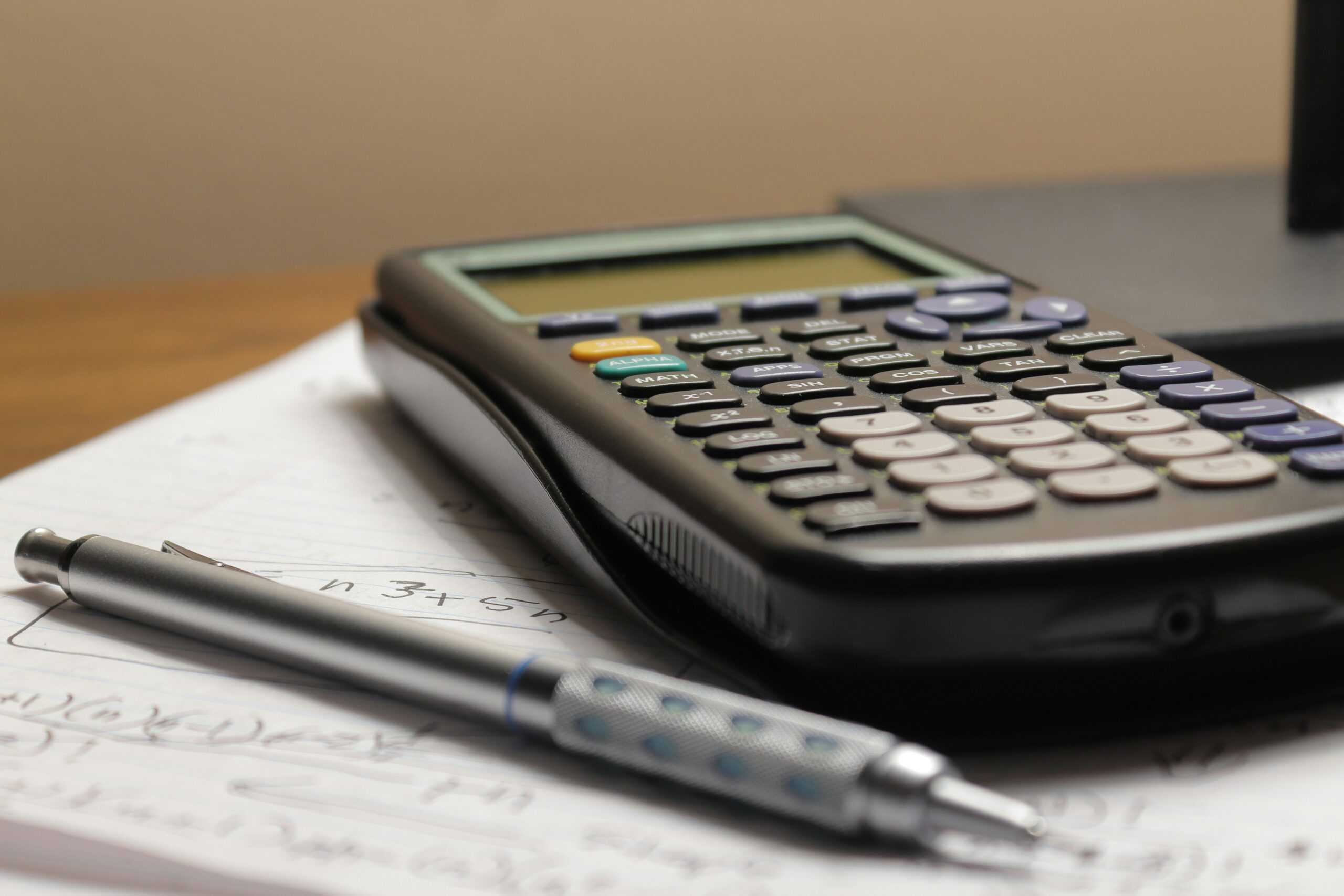

Throughout the two-week holiday, you’ll enjoy a reprieve from sales tax and local option tax on various school-centric goods. This break extends to clothes, shoes, and accessories such as backpacks, each under $100. It includes wallets, handbags, fanny packs, and diaper bags too, all considered as essentials for returning to school and are tax-exempt. Moreover, educational materials, including pens, pencils, notebooks, calculators, and similar, priced less than $50 each, fall under this tax-free period. Additionally, learning tools and jigsaw puzzles, like books and flashcards, will be exempt if their price doesn’t exceed $30 per item.

Personal computers, laptops, monitors, and certain computer accessories with prices up to $1,500 will also be included when purchased for home and noncommercial use. The term “personal computer” does not cover all mobile and electronic devices. Cellphones and gaming consoles are not exempt from sales tax. However, devices aside from desktop and laptop computers covered by the holiday include electronic book readers and tablets. The list of approved computer-related accessories exempt from sales tax includes keyboards, mice, routers, and non-recreational software.

Parents will be happy to know that there is no limit to the amount of sales tax-free items you can purchase during the two-week time frame. The discount also applies to items purchased online as long as the company accepts the order during the holiday period regardless of the delivery date. Companies can choose to opt out of the sales tax holiday, but they must notify the Florida Department of Revenue by December 23, 2023 to do so. A notice that the business is not participating must be placed in a conspicuous location so customers are aware. The same restrictions applied to the sales tax holiday this summer.

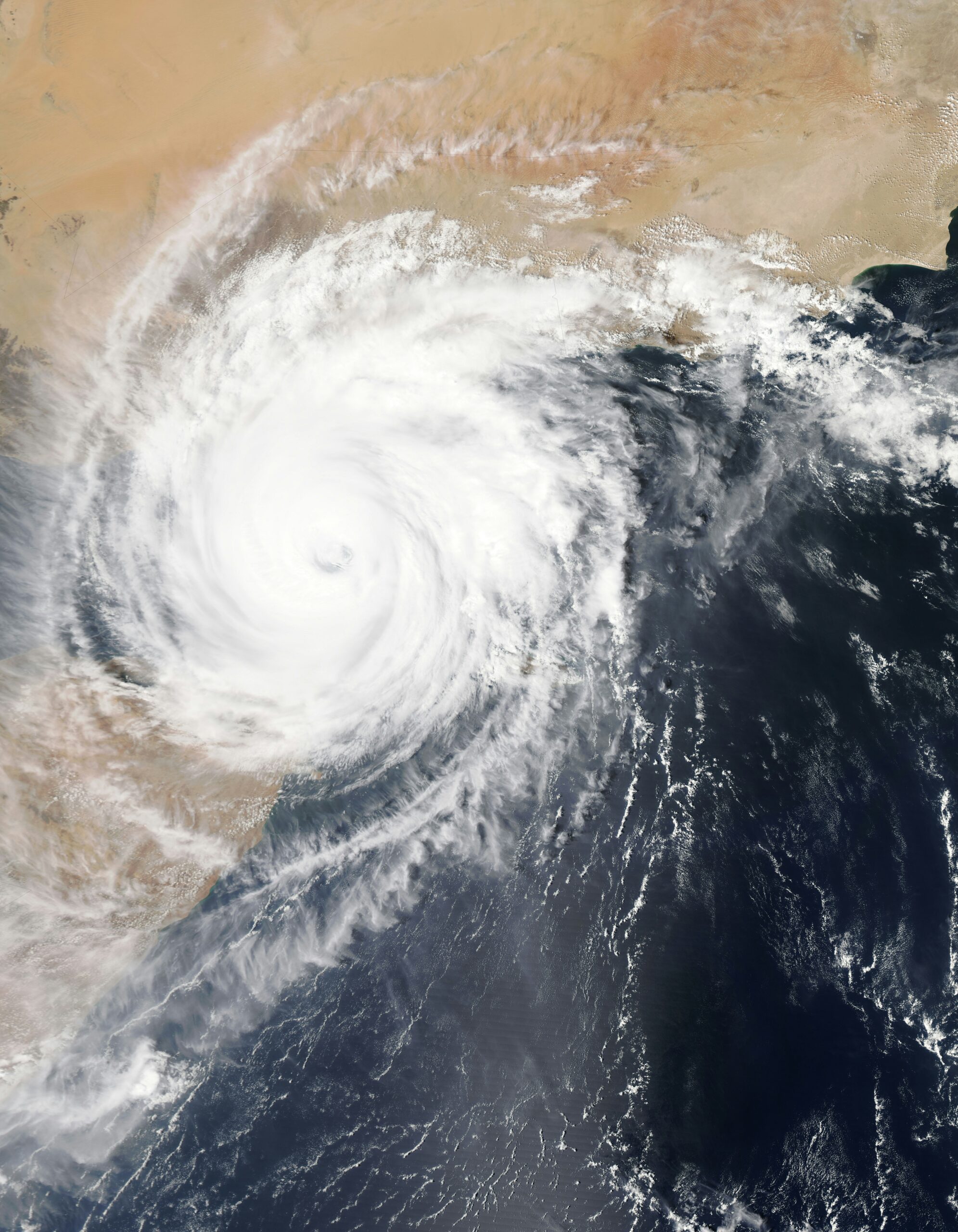

In addition to the sales tax holidays designated for back-to-school, Florida Governor Ron DeSantis signed a $1.3 billion sales tax relief bill into law last June. It marked the largest tax cut in the state’s history and defined the year’s tax holidays. Nearly all baby products became exempt from sales tax, including diapers, changing tables, cribs, clothing, bottles, and much more. The state traditionally has a disaster preparedness sales tax holiday that is similar to the back-to-school holiday. The tax relief bill designated that Florida will now have two disaster preparedness sales tax holidays per year, for items like generators, laundry detergent, and portable pet kennels.

Florida residents were also granted a summer-themed sales tax holiday, a tax break on gas stoves, a reduction in business taxes, and an extension on filing their 2022 federal taxes from the bill.