Image credit: Pexels

For the cryptocurrency community, 2025 continues to be quite an unpredictable year. Most recently, a Miami-bound crypto company, Unicoin, has been facing challenges with one of the significant market regulators, the Securities and Exchange Commission (SEC).

The SEC originally gave Unicoin until April 18th this year to agree upon a settlement. However, Unicoin’s CEO, Alex Konanykhin, has no plans to back down as they move to fight the charges against their business in the courtroom.

Unicoin and Its Battle Against the SEC

Unicoin is a Miami-based crypto investment firm that recently caught the attention of the SEC. The SEC, known for its unbending regulatory announcements regarding the crypto scene, has been pursuing legal action against Unicoin since the start of this year. As a result, Unicoin must prepare to stand in court against a well-established Wall Street authority.

Unlike other crypto firms, Unicoin boasts a token and ecosystem involving media companies and software services agencies. While the altcoin is not yet tradable in the United States (US), the asset is marketed as a promissory token, providing investors access to future value funded by the business’s portfolio.

Konanykhin states that the co-founder of the SEC’s Division of Enforcement initially gave Unicoin a deadline of April 18th to enter into a settlement discourse. According to the SEC, the crypto company is facing allegations of knowingly and intentionally violating registration and antifraud provisions of federal securities law.

With April 18th in the wind, the passed deadline signals something serpentine ahead. Konanykhin states that he doesn’t intend to settle, promising to fight these claims in court instead.

Why Unicoin Is At Odds With the SEC

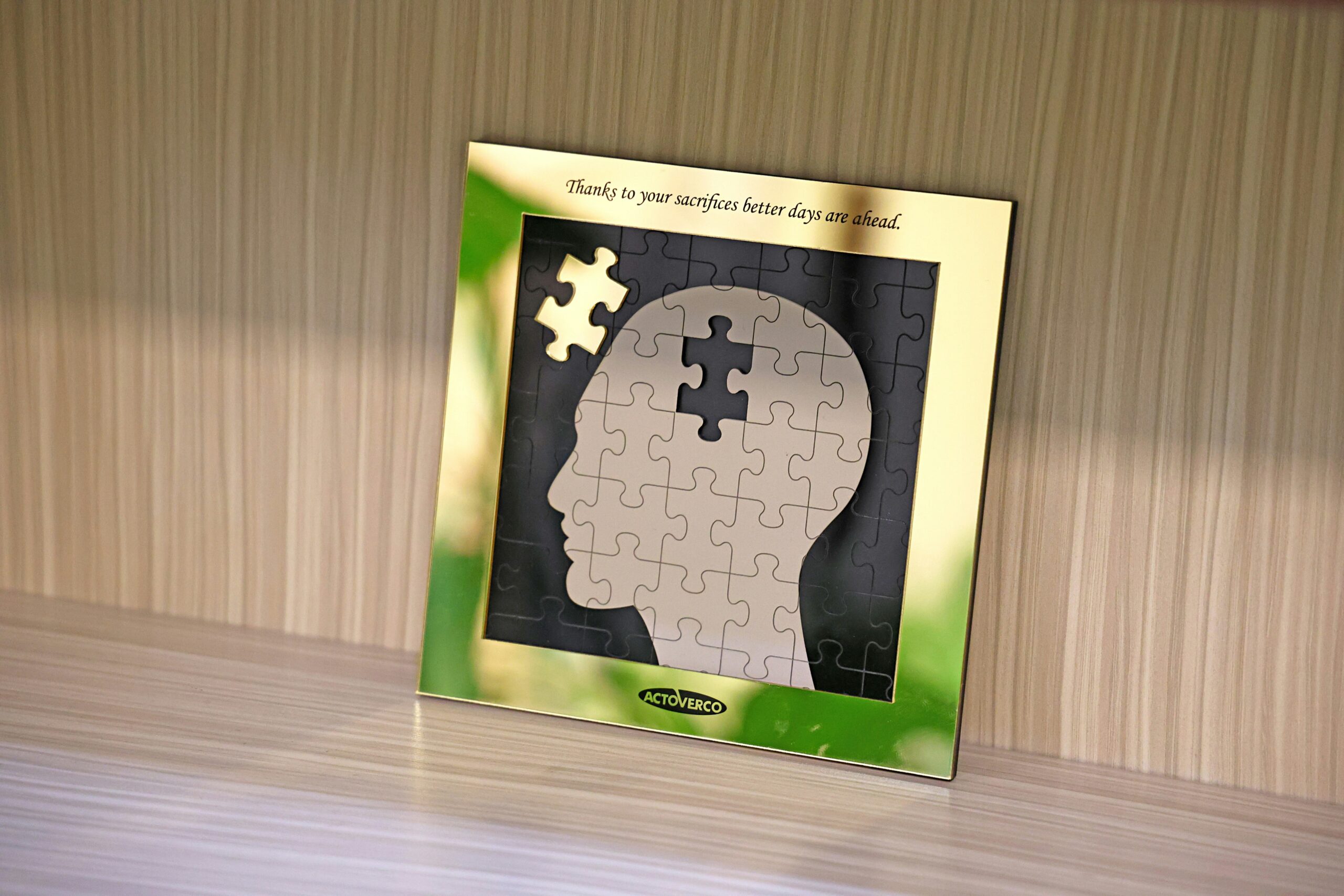

Konanykhin comments that his company has been appropriately reporting financial disclosures to the SEC for OVER three years, making this lawsuit feel like a brick to the face.

Now, the Unicoin CEO plans to consider defensively suing the regulatory agency for what he believes is extreme, “multi-billion-dollar damage” to Unicoin’s business and its shareholders. As of right now, no representatives at the SEC have stepped up to reply publicly.

The crypto agency initially aimed to highlight and promote its business model using a marketing campaign in New York City that included adverts on taxis, billboards, and city buses. This ad blitz soon caught the eye of the SEC, which led to the regulator opening an investigation.

Under new government leadership across the US, the SEC’s desire to pursue Unicoin almost appears counterproductive at first glance, especially considering the current administration seems much more crypto-accepting than previous ones.

Despite the new leadership’s welcoming nature regarding cryptocurrency, Unicoin still faces comprehensive and possibly more severe accusations, such as violating antifraud provisions of the Securities Act and the Exchange Act. In the latest public statements against crypto coins, Acting Chair Mark Uyeda of the SEC shared its objective to continue its pursuit of cases relating to fraud of any sort.

Next Steps for Unicoin

Although the SEC seems determined that its case is valid, Alex Konanykhin boldly denies any claims or complaints against his company.

He additionally voices that the push to penalize Unicoin is powered by the SEC’s previous leadership under Gensler.

Konanykhin also notably identified Brad Ney, the assistant director within the enforcement division who boasts ten years of employment at the SEC, as the man leading the regulatory agency’s investigation into Unicoin. While the crypto company owner doesn’t believe the lawsuit and investigation properly reflect “the views of the new SEC leadership,” he has no plan to back down.

Unicoin’s request for a vis-à-vis interaction with the Crypto Task Force showcases the firm’s commitment to combatively approaching the SEC’s issues in the future.